Let’s get this first part out of the way; any income you generate from any type of company, or any other entity that sends you IRS information just after the beginning of the year, you have to claim it as income on your taxes.

This is one of the most searched items on the internet, and it’s because of the promise most people read that tells them how much money they could possibly earn if they started doing all types of surveys. There’s a very… VERY… small number of people who make out big taking paid surveys on all kinds of things, and the reality is that very few people end up having to file any taxes at all. Does that sound like a viable income source?

Let’s start off with this bit of reality. Anyone signing up to do surveys that might pay you has to give up a lot of personal information. Many of the large survey companies have been given an A rating for trustworthiness, which is a good thing, but not so much when it comes to making a lot of money… enough so you’d have to worry about reporting anything to the IRS.

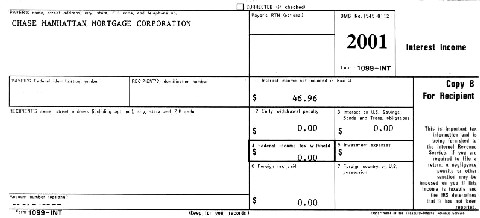

By law, anyone that makes at least $600 a year has to be sent a tax document, indicating how much money you’ve been paid. Most of these companies don’t take money out of your income because they don’t actually pay you money or write checks. Most payouts come in the form of gift cards; Visa’s a favorite to use. It turns out you can transfer the worth of a gift card into money that you can put in the bank, but if you earn enough in the year you’ll have to pay taxes on it.

If you’ve read anything online, you see how easy it seems to be to do surveys and make a lot of money. However, there’s two major things you have to know concerning this. The first is that you end up having to take a lot of pre-survey tests to determine if you qualify for any of the surveys that actually pay you for your services. They might range from between $20 to $750… which looks like a great gap.

Depending on how long and detailed the survey is, there’s a remote possibility that you could make a lot on one extensive survey. By remote, I mean that if you’re in a pool of 1,000 people and they only need 20 or less, you have a 2 in 100 opportunity to be selected. That doesn’t sound good enough, does it?

The second is that most of the rated survey companies give you a set amount of points you have to accumulate in order to paid anything, and some of them say it has to be earned within a 12-month period of time. One of the major companies gives you 5 credits just for filling out an initial pre-survey to see if you’re good for the next survey. You have to earn 1,000 points to get $20. That means you’d have to be chosen to do 200 pre-surveys just to get any kind of payment; if your time worth enough to possibly make $20 a year?

For the right just to get into the system, here’s some of the personal information you might need to give up:

* social security number

* passport number

* bank account number

* credit card numbers

* debit card numbers

* health insurance information

* personal information: married, sex, race, gender identity

* personal property records

* internet activity

There’s more things you could be asked for, and though you can always opt out of any of these companies, I couldn’t find anything saying what they’ll do with your information whether or not you leave.

Still, the general question we’re answering here is whether or not you have to claim anything or pay any taxes on a yearly basis. Overwhelmingly, most people who get into this can easily answer no. For those who made enough money, you’ll receive something from the company that you’ll have to pay taxes on, at least if any other income you generated in the year brings you to the threshold where you’ll have to pay taxes regardless.

Something to think about.

TL Wall Accounting Blog